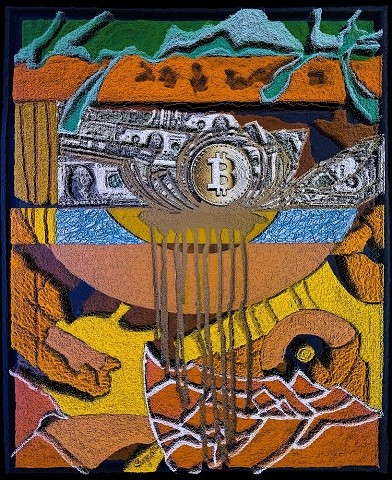

- image from the Future of Money NFT collection

- text originally published Dec 2020 elsewhere, but my opinion has not changed since then

I have been thinking about the meaning of money for some time now.

One of the most compelling ways of describing it is to say that Money is “an instrument to facilitate trade”.

If I produce tomatoes, and I need bread, I can go to the baker and exchange my tomatoes for bread. But that only works if the bread maker needs tomatoes at the same time that I need bread. Money solves that problem, and other more complex ones, by providing a common instrument that can be exchanged with bread and tomatoes whenever we need these or other goods.

I will not go into too much detail, but I will mention that the form that money takes, which I will call a “token”, has evolved with time, going from skulls and teeth of dead animals to gold and silver, to bills printed by governments, to now their digital version in the form of a record in a balance sheet. In the current form, governments of different countries or groups of countries issue (create) these tokens. The value that these tokens have depends to a great extent on how much people trust the governments that issue them.

For international trade, a reference needs to be used and, in the last few decades, the US Dollar has been the reference token.

There is no question that the current system has provided great benefit to the global exchange of goods. However, there is plenty of room for improvement in the following areas:

- A single country controls the reference currency, its supply is limitless, and it can be manipulated.

- Transferring money across borders requires intermediary institutions, it can take days, and it can be expensive.

- Transactions are hard to trace.

In 2008, a new technology (blockchain) was developed to create a new type of money, a programmable form of money, known as a cryptocurrency. The original and dominant one is Bitcoin, but many others with different useful features were created later. Bitcoin is secure by design, and all transactions are traceable and public. It is not issued by any single country, but a perfectly defined algorithm generates it. There is a limited supply (approximately 21,000,000) that will ever be issued. It cannot be corrupted and manipulated. Transactions are peer-to-peer, do not need an intermediary, and are not affected by international borders. A decentralized global network of computers runs the bookkeeping of the transactions, and anyone can contribute and get rewarded for maintaining the network.

I am certain that Cryptocurrencies in general, not just Bitcoin, will transform global trade, and they will enable an improved financial system, more transparent and traceable, in which no single country is in full control. Cryptocurrencies already facilitate fast, relatively inexpensive, person-to-person transactions without the need for financial institutions, regardless of international borders. This is already happening, I have benefited from using them (especially Bitcoin) a few times already, and it is obvious to me that we have passed the turning point. There are already enough people and institutions using them. I am conscious of the need for regulations and interfacing with traditional financial systems, and for governments to be able to collect taxes related to transactions. Regardless of the regulatory framework that develops, there is no going back. Bitcoin, and some other cryptocurrencies, are here to stay.